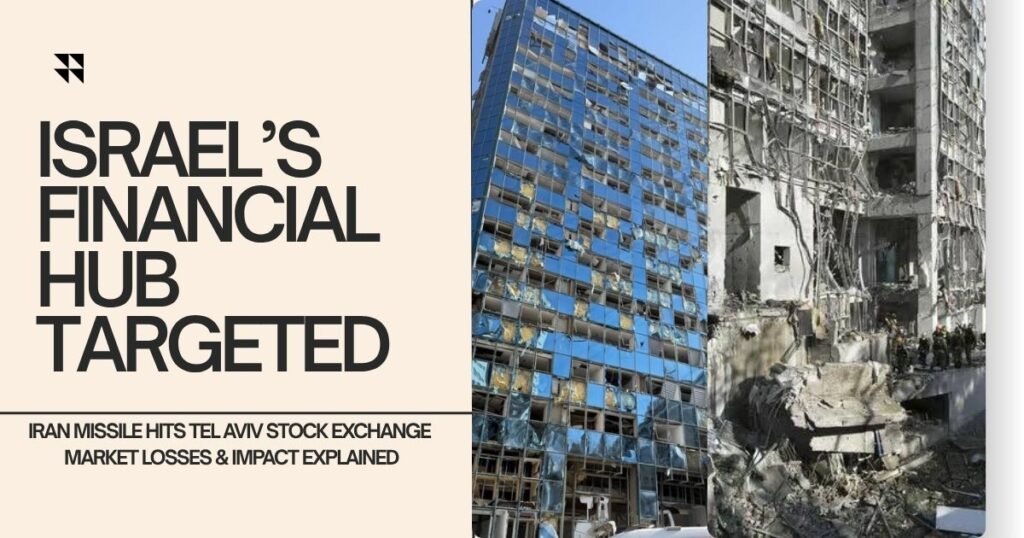

The Tel Aviv Stock Exchange building was damaged in an Iranian missile strike on June 19, 2025. Explore the full financial impact, stock market losses, investor sentiment, and recovery forecast.

Overview: Missile Strike Hits Heart of Israel’s Financial System

On June 19, 2025, Iran launched a barrage of missiles on Tel Aviv, directly targeting key infrastructure. Among the impacted sites was the Tel Aviv Stock Exchange (TASE) building — a central hub for Israel’s capital markets. Verified footage shows extensive structural damage, but officials confirmed that core trading operations remain unaffected.

This unprecedented escalation raised major questions for traders and analysts alike:

Is the Tel Aviv stock market destroyed?

How much was lost in Israeli equities?

Should investors stay or exit?

Also Read: Iran vs Israel War 2025: Full Breakdown, Timeline, Numbers & Analysis

Track the full timeline of the Iran-Israel conflict, including every major strike, escalation phases, casualties, and geopolitical implications — essential context behind the market impact.

Is the Tel Aviv Stock Market Destroyed?

No — while the building was visibly damaged, the Tel Aviv Stock Exchange itself is still operational. Thanks to digitized infrastructure, including remote trading platforms and cloud systems, trading has not been suspended.

Emergency teams were deployed immediately, and no casualties inside the exchange were reported.

Market Response: Volatility, Not Collapse

What Happened After the Strike?

- The TA-35 Index fell by 3.2% intraday, its sharpest single-day drop since early 2024.

- Financials and insurers led the decline, with banks like Leumi and Mizrahi losing between 4–6%.

- The Israeli Shekel (ILS) briefly weakened against the USD before recovering.

- Trading volume spiked as risk algorithms and panic selling triggered auto-liquidations.

Despite the hit, the TASE did not shut down — reaffirming investor trust in its contingency systems.

Estimated Financial Losses from the Missile Strike on Tel Aviv Stock Exchange

Market analysts estimate:

- Over 11.5 billion ILS (~$3.1 billion USD) in market capitalization loss within the first trading day.

- Leading financial institutions and real estate stocks lost substantial short-term value.

- The TA-90 Index also declined by 2.8%, reflecting broader investor uncertainty.

These losses, while significant, are largely expected to be temporary and driven by emotion rather than weakened fundamentals.

“The TASE was shaken, not broken,” said Dr. Eli Navarro, Senior Economist at Tel Aviv University. “As long as conflict escalation is contained, market value could recover in Q3 2025.”

Historical Perspective: A Market That Bounces Back

This isn’t the first time the Tel Aviv Stock Exchange has faced turbulence. Past conflicts have shown:

- During the 2021 Gaza conflict, the TASE dipped 4% but rebounded within two weeks.

- In late 2023, following military flare-ups, the TA-35 Index not only recovered but ended the year up 12%.

Israel’s diverse economic foundation, driven by tech, cybersecurity, and clean energy, often leads to fast recovery once uncertainty fades.

Government & Institutional Response

Within hours of the incident, the Israel Securities Authority (ISA) and Ministry of Finance released joint statements confirming:

- Trading systems were safe and operating from off-site locations.

- Investor accounts, trades, and capital remained unaffected.

- Cybersecurity operations are under full alert to prevent further disruption.

ISA also warned against market manipulation during the crisis and activated investor protection protocols.

Global Investor Outlook: Should You Worry?

While the missile strike shook short-term confidence, Israel’s core investment appeal remains strong. The country’s leading sectors — defense, tech, and fintech — continue to attract long-term global capital.

Many investors are now searching answers to timely questions:

- “Is it safe to invest in Israel now?”

→ Yes, if you have a long-term horizon and diversify into resilient sectors like tech and defense. - “Should I sell Israeli stocks in 2025?”

→ Unless the conflict expands, selling may lock in short-term losses unnecessarily. - “What is the TASE index outlook during conflict?”

→ Based on historical precedent, the index could recover within weeks. - “How stable is the Tel Aviv stock market during war?”

→ Very stable — operations continue even when buildings are hit. - “What is the impact of the Iran-Israel war on stock trading?”

→ Heightened volatility, sector-specific sell-offs, but no systemic crash.

Investors are advised to monitor developments and avoid decisions driven solely by headlines.

Final Thoughts: The Symbolic Hit That Didn’t Break the Market

The Iranian missile strike on the Tel Aviv Stock Exchange building was a dramatic and symbolic act — but it did not cripple the market. Despite visible damage and billions in temporary losses, the exchange remained open, active, and resilient.

As with previous crises, Israel’s financial sector appears poised to recover, and possibly even grow stronger in the aftermath.