Full breakdown of the Elon Musk and Donald Trump 2025 clash—Tesla’s $150B collapse, Epstein jabs, political retaliation, and market shockwaves

Elon Musk vs Donald Trump: Inside the $150 Billion Feud That’s Shaking Wall Street, Washington & the Web

🧨 Introduction

The clash between tech titan Elon Musk and former U.S. President Donald Trump has ignited a cultural, political, and economic firestorm. What began as a disagreement over fiscal policy has now evolved into a high-stakes public feud involving $150 billion in lost market value, dark Epstein-era accusations, and threats to cancel federal contracts for Musk-led companies including Tesla, SpaceX, and Starlink.

This is not just a Twitter feud—it’s a seismic collision of egos, ideologies, and empires. And it may very well change the political and economic landscape of America heading into 2026.

A Complicated History: Musk & Trump Before the Fallout

The Musk–Trump relationship has never been straightforward.

In 2017, Musk served briefly on Trump’s advisory council before stepping down over the Paris Climate Accord withdrawal. Over the years, he’s both praised and criticized Trump, labeling him a “chaotic disruptor” in 2020 but also hinting at support for some of his deregulation policies.

Trump, in turn, once hailed Musk as a “great genius” but frequently expressed frustration that Tesla and SpaceX received subsidies while Musk showed little loyalty.

“I gave him the world, and he gave me tweets,” Trump reportedly told advisors in late 2022.

Fast-forward to 2025, and tensions finally snapped.

🕰️ Timeline: How It All Unfolded

📅 June 3, 2025: Musk Calls Out Trump’s “Big, Beautiful Bill”

- During a livestreamed interview, Musk criticized Trump’s latest legislation aimed at subsidizing oil, coal, and gas industries at the expense of green tech.

- Musk called it a “disaster for America’s clean energy future”, accusing Trump of being beholden to “fossil fuel oligarchs.”

- He warned investors that EV subsidies could be in danger if Trump were re-elected.

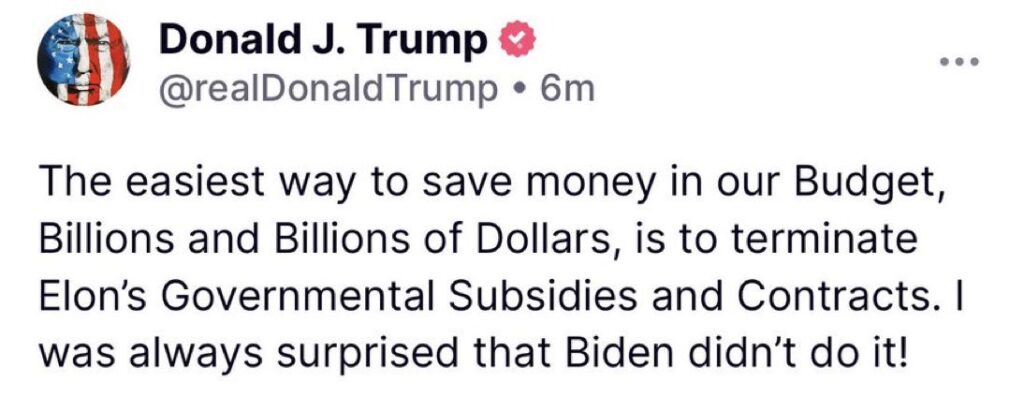

📅 June 4, 2025: Trump Fires Back on Truth Social

- Trump slammed Musk as “an ungrateful brat made rich by Republicans”, claiming his administration had “made Tesla and SpaceX possible.”

- The post hinted that a second Trump term would involve “real accountability” for tech billionaires who turned against America’s working class.

- He directly suggested canceling Tesla’s federal tax credits and reconsidering military contracts with SpaceX and Starlink.

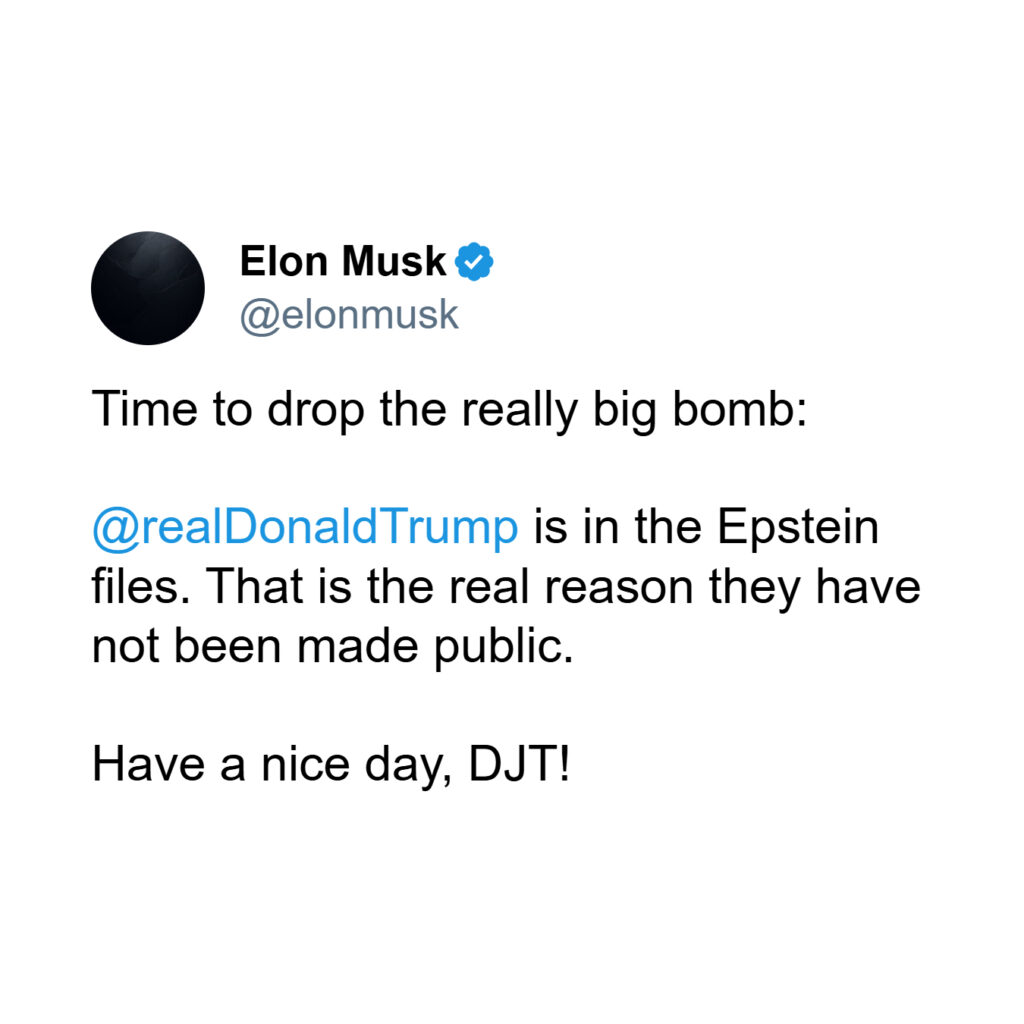

📅 June 5, 2025: Musk Mentions Epstein, Sparks Firestorm

- In a tweet that immediately went viral, Musk posted: “Those who partied with Epstein should probably not talk about morality or fiscal discipline.”

- Though no names were mentioned, the implication toward Trump—who was once publicly linked to Jeffrey Epstein—was unmistakable.

- Within hours, #ElonVsTrump, #TeslaCrash, and #MuskEpsteinBomb were trending worldwide.

📉 Financial Market Meltdown: $150 Billion Lost

The feud triggered massive investor uncertainty:

| Company | Drop | Value Lost |

|---|---|---|

| Tesla (TSLA) | –14.2% | ~$150 billion in value wiped out |

| Trump Media (DJT) | –8.1% | ~$4.7 billion lost |

| SpaceX (Private) | Internal panic over DoD contracts | |

| Starlink | Regulatory concern over FCC threats |

The Nasdaq dropped 0.8%, reflecting broader tech sector anxiety. Analysts now say the feud introduced a “Trump Premium Risk Factor” to stocks associated with climate tech.

🏛️ Political & Contractual Fallout

Trump-aligned lawmakers began calling for a full review of:

- Tesla’s clean vehicle tax incentives

- SpaceX’s NASA and Department of Defense launch contracts

- Starlink’s licensing and regulation with the FCC

- Possible DOJ/SEC investigations into Musk’s political interference

The threats are being taken seriously. Musk’s companies depend heavily on federal money and regulatory goodwill, especially for defense, infrastructure, and global satellite licensing.

🧬 The Epstein Shadow: Why Musk’s Tweet Matters

The Epstein reference struck a cultural nerve. Trump’s past associations with Epstein are well-documented, including flight logs, Mar-a-Lago parties, and old interviews. Musk’s jab could reawaken media scrutiny around:

- Trump’s long-denied connections with Epstein

- 2020s-era court documents still under seal

- A brewing effort by advocacy groups to reopen investigations under new whistleblower protection laws

It also paints Trump as morally compromised, allowing Musk to occupy high ground as a “clean capitalist.”

👨👦 Errol Musk’s Public Warning

In an unexpected twist, Elon’s father, Errol Musk, gave a rare interview to a South African publication:

“This is a clash between two alpha males. But Elon must remember—Trump is still incredibly powerful. Presidents can do real damage, not just tweets.”

This sober assessment underscores how personal—and dangerous—this feud has become, even within the Musk family.

🕊️ White House Mediation?

White House insiders leaked that the Biden administration is:

- Monitoring national security implications if SpaceX contracts are canceled

- Working behind the scenes to reassure markets

- Considering informal back-channel diplomacy to de-escalate the feud

Musk, in a more conciliatory tone on June 6, posted:

“Time to make peace. Differences aside, the mission must continue.”

But so far, Trump has not responded—publicly or privately.

🎯 High-Stakes Takeaways

1. Tech vs. Populism: The Growing Battle Between Elitist Clean-Tech Billionaires and Anti-Establishment Populist Leaders

The ongoing feud between Elon Musk and Donald Trump is a stark representation of the intensifying ideological conflict between elitist clean-tech billionaires and anti-establishment populist figures in modern America. Musk, the face of innovation in electric vehicles, space exploration, and renewable energy, epitomizes the Silicon Valley elite who push for rapid technological advancement and climate change solutions. On the other hand, Trump’s populist rhetoric taps into the sentiments of voters skeptical of globalization, automation, and what they perceive as an out-of-touch tech elite.

This clash symbolizes:

- The war between Silicon Valley’s clean energy visionaries and nationalist populist politics.

- How anti-elite narratives are used to challenge technological progress and corporate influence in American society.

- The broader cultural and political polarization in the United States centered around technology adoption, economic inequality, and environmental policy.

- How this tech vs. populism conflict influences U.S. policy-making on clean energy subsidies, innovation funding, and regulation of tech giants.

This feud thus highlights the deep divide between those embracing a future driven by innovation and those rallying against perceived threats to traditional industries and values.

2. Weaponizing Federal Power: How Trump’s Administration Uses Government Tools to Target Critics Like Elon Musk

Donald Trump’s public attacks on Elon Musk demonstrate a growing trend in which federal government agencies and regulatory bodies become instruments of political power, used to suppress or retaliate against outspoken critics. From SEC investigations to Department of Defense contract reviews, government mechanisms are being weaponized in the Musk-Trump conflict.

Key points include:

- The potential use of SEC audits and investigations targeting Tesla’s financial disclosures and SpaceX’s contracts as political leverage.

- Federal contract reviews and potential revocations that could jeopardize billions in business for SpaceX, especially under Trump-aligned officials.

- The threat to federal electric vehicle tax credits and subsidies vital to Tesla’s growth, which could be rescinded or reduced amid political pressures.

- How these actions reflect a broader strategy of using government authority to intimidate or silence influential tech leaders who do not align politically.

This weaponization of federal power raises concerns about the integrity and independence of U.S. regulatory institutions, threatening the innovation ecosystem and chilling political dissent among corporate leaders.

3. Market Fragility Exposed: How a $150 Billion Feud Between Elon Musk and Donald Trump Shakes Investor Confidence

The massive $150 billion market capitalization loss linked to the Musk-Trump feud underscores a fragile financial ecosystem highly sensitive to the whims of influential personalities. When conflicts between two powerful figures can trigger such a monumental impact, it reveals how modern stock markets often rely more on charisma and public perception than on fundamental business performance.

Insights include:

- The volatile nature of Tesla’s valuation, which is heavily influenced by Elon Musk’s personal image and public statements.

- How investor sentiment and market confidence can rapidly decline in response to political controversies and social media disputes.

- The ripple effects on related sectors such as electric vehicle manufacturers, clean energy stocks, and aerospace contractors.

- The dangers of overreliance on individual CEOs’ reputations, making companies vulnerable to political and social turbulence.

This market fragility highlights the necessity for investors to incorporate risk management strategies considering political risks and media-driven volatility in today’s stock market landscape.

4. Election Strategy? Why Donald Trump Is Targeting Elon Musk to Reignite His Political Base and Distract from Legal Troubles

Political analysts widely speculate that Donald Trump’s public feud with Elon Musk is part of a deliberate election strategy to consolidate his populist support and manage political distractions. By framing Musk as a representative of the “tech elite,” Trump seeks to:

- Reignite enthusiasm among his core supporters by positioning himself as the champion of anti-elitist values against powerful billionaires.

- Distract public and media attention from ongoing legal investigations and congressional probes targeting Trump himself, using high-profile conflicts as a diversion.

- Reinforce his political brand as the “anti-elite warrior”, a message that resonates with voters wary of globalization, Silicon Valley influence, and perceived economic inequities.

- Leverage the feud for media coverage and social media traction, increasing visibility during critical phases of the 2024 and 2026 election cycles.

This strategic targeting underscores the increasing entanglement of personal feuds with national political campaigns, where conflicts with prominent figures are weaponized for electoral gain and voter mobilization.

🌐 What the Internet Thinks

@FinanceBullet: “Tesla just had its worst 24h since 2022. This is not normal volatility—it’s political warfare.”

@TechCrunchies: “Musk just Epstein-shamed a presidential frontrunner. That’s next-level.”

@USWatchdog: “Expect hearings. This might trigger SEC inquiries or DOJ memos by next week.”

📈 For Investors, the Future is Foggy

- Expect extreme volatility in TSLA for weeks.

- Watch for any SEC filings from Tesla or DOJ pressers.

- Follow SpaceX mission updates—contractual freezes may delay launch schedules.

🚀 Final Thoughts

This is not just a tech feud or a political sideshow—it’s a collision of capital and control, truth and power. With over $150 billion in damage, reputational risk, and real-world implications for space, energy, and digital freedom, Elon vs Trump is the defining story of mid-2025.

The ongoing feud between Elon Musk and Donald Trump goes far beyond a mere personal spat—it is a microcosm of larger forces shaping the future of technology, politics, and the economy. This conflict highlights the stark divide between Silicon Valley’s clean-tech billionaires and anti-establishment populist leaders, illustrating how political power can be wielded to influence regulatory bodies, government contracts, and market confidence.

With a staggering $150 billion market capitalization wipeout tied to their clash, it exposes the fragility of markets overly dependent on personality-driven narratives rather than underlying business fundamentals. Moreover, the strategic nature of this feud—potentially aimed at mobilizing political bases and distracting from ongoing legal investigations—reflects the growing interplay between personal rivalries and electoral politics in the 2020s.

For investors, policymakers, and observers alike, the Musk-Trump saga is a critical case study in how political risks, government weaponization, and populist rhetoric can disrupt innovation ecosystems and market stability. As this story unfolds through 2025 and beyond, its repercussions on Tesla stock, SpaceX contracts, and the broader tech landscape will continue to be closely watched.

Frequently Asked Questions (FAQs)

1. What is the Elon Musk vs Donald Trump feud about?

The feud centers on political and ideological differences between Elon Musk, a clean-tech billionaire leading Tesla and SpaceX, and Donald Trump, an anti-establishment populist leader. It involves public criticisms, threats to government contracts, regulatory scrutiny, and impacts on stock markets.

2. How has the Musk-Trump conflict impacted Tesla and SpaceX financially?

The feud has contributed to a volatile market environment, causing an estimated $150 billion loss in market value linked to investor uncertainty and political risks affecting Tesla’s stock and SpaceX’s government contracts.

3. Why is Donald Trump targeting Elon Musk politically?

Analysts suggest Trump’s attacks on Musk are part of a strategy to reignite his political base, portray himself as an anti-elite warrior, and distract attention from his ongoing legal investigations and controversies.

4. How can federal government agencies be weaponized in political feuds?

Government bodies like the SEC or Department of Defense can be used to launch audits, investigations, or contract reviews against companies led by political opponents, leveraging regulatory power to apply pressure or cause financial harm.

5. What does this feud mean for the future of clean energy and technology?

This conflict underscores the tension between innovation-driven tech elites and populist political movements skeptical of globalization and technological disruption. It may affect government subsidies, clean energy policies, and investor confidence in tech companies.

6. How should investors approach Tesla and SpaceX amid this feud?

Investors should consider the increased political risks, regulatory uncertainties, and market volatility stemming from this high-profile conflict and diversify portfolios accordingly.

7. Is this feud likely to influence upcoming elections?

Yes, many political experts believe the Musk-Trump feud is a deliberate election strategy to mobilize populist voters and shift media attention during crucial campaign periods in 2024 and beyond.

📢 Stay with FrissonX

✔ Daily updates on political-tech conflict

✔ Real-time stock crash alerts

✔ Uncensored coverage with global perspectives

Subscribe, share, and be part of the disruption.