Introduction: The Ripple Effects of Trump’s 2025 Tariffs on Global Trade

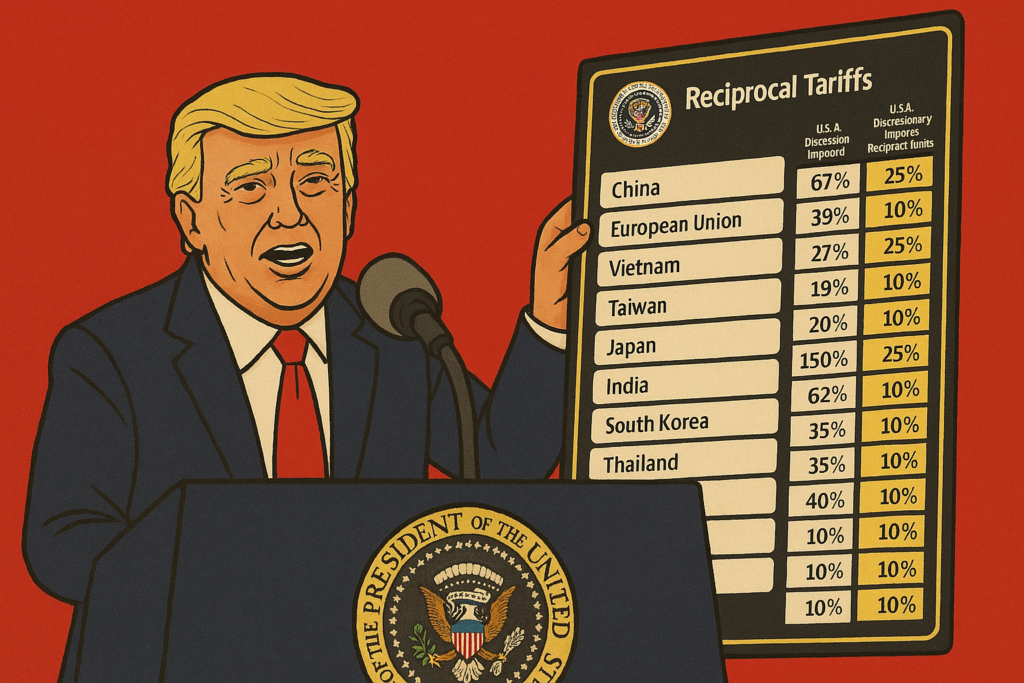

In 2025, the global trade landscape was significantly reshaped when former President Donald Trump reintroduced aggressive tariff policies under his “America First” economic agenda. These tariffs, ranging from 15% to 30% on a wide array of goods, primarily targeted the economies of major trading partners such as China, the European Union (EU), India, and several other countries. Trump’s tariffs were intended to protect U.S. industries, reduce trade deficits, and ensure American jobs and businesses were prioritized. However, these policies sparked retaliation from countries around the world, resulting in a complex web of trade tensions, which have had significant ramifications for global economic stability.

As these tariff wars intensify, countries have had to navigate both retaliatory measures and strategic shifts in trade partnerships. This article explores the impact of Trump’s 2025 tariffs on key global economies, providing a detailed breakdown of how countries like China, the EU, India, Mexico, Canada, and others are responding. We will analyze how each country has reacted, what tariffs they are imposing on U.S. imports, and how these retaliations affect the global economy.

Trump’s 2025 Tariffs: A Bold Move with Far-Reaching Consequences

The 2025 tariffs initiated by the Trump administration are a continuation of the protectionist policies that defined his first term in office. These tariffs primarily target industries critical to the U.S. economy, such as technology, manufacturing, and agriculture. The tariffs are structured to address perceived trade imbalances and unfair practices by other nations, particularly China. For instance, the U.S. imposed tariffs on Chinese electronics, steel, aluminum, and agricultural products, ranging between 20% and 30%, while European countries saw similar tariffs on autos and manufactured goods.

Trump’s tariffs are part of a broader strategy aimed at revitalizing American manufacturing and reducing the U.S. trade deficit, particularly with countries that have historically run large surpluses with the U.S. In addition, the tariffs are intended to put pressure on these nations to negotiate more favorable trade deals, particularly with China, which has long been a focus of U.S. trade concerns.

However, these tariffs have created a ripple effect across the world, with several countries implementing retaliatory tariffs of their own. This has led to a complicated set of trade relationships, with countries looking to safeguard their economic interests, while also attempting to minimize the negative effects of the escalating trade war.

China: The Epicenter of Trump’s Tariff Battle

China has been the primary target of Trump’s 2025 tariffs, with the U.S. imposing some of the harshest measures on Chinese imports. The U.S. tariffs on Chinese goods cover a wide range of products, including electronics, steel, aluminum, machinery, and agricultural products. The total value of goods subject to tariffs from China exceeds hundreds of billions of dollars, with some tariffs reaching 25% on high-tech products and steel imports.

In response, China has retaliated in kind. Beijing imposed its own set of tariffs on U.S. exports, which included agricultural goods such as soybeans, pork, and corn—key exports for U.S. farmers. Tariffs were also levied on American automobiles, electronics, and aircraft. These retaliatory tariffs were aimed at sectors where the U.S. has significant exports to China, particularly in agriculture, manufacturing, and technology.

The Chinese response reflects the complex and highly interdependent nature of U.S.-China trade. Despite the tariffs, China continues to maintain a large trade surplus with the United States, which is a primary point of contention. China’s retaliation also includes non-tariff barriers, such as restrictions on American companies operating in the country and limitations on technology transfers.

A Detailed Breakdown of the U.S.-China Tariff Clash

- U.S. Tariffs on China:

The United States initially imposed a 25% tariff on $250 billion worth of Chinese imports, including machinery, electronics, and consumer goods. In 2025, additional tariffs were placed on high-tech products, such as telecommunications equipment and semiconductors. Agricultural products like soybeans were also hit with a 25% tariff, exacerbating the already strained relations between the two countries. - China’s Retaliation:

In response, China enacted its own set of tariffs on U.S. goods, specifically targeting products such as soybeans, cars, and aircraft. The tariffs ranged from 15% to 25%, impacting U.S. farmers and manufacturers. China also imposed measures that restricted U.S. companies’ ability to operate freely in the country, particularly tech firms such as Apple and Microsoft, which have a significant presence in China. - Current Tariff Landscape:

As of 2025, the U.S. has imposed tariffs on a wide range of Chinese goods, with China responding similarly. The economic impact of these tariffs has been felt on both sides, with higher consumer prices, disrupted supply chains, and reduced trade volumes. The broader geopolitical implications include the shifting of trade alliances, with China looking to strengthen ties with countries in Asia, Europe, and Africa.

The European Union: Defending Economic Interests Amid Trump’s Tariff War

The European Union, as one of the largest trading blocks in the world, has been significantly affected by Trump’s 2025 tariffs. The U.S. tariffs on European steel and aluminum were followed by new tariffs on a range of EU products, including automobiles, aircraft, and agricultural goods. These tariffs were part of Trump’s broader strategy to reduce the U.S. trade deficit and protect domestic industries from foreign competition.

In retaliation, the European Union implemented its own set of tariffs on American goods, targeting products like whiskey, motorcycles, and agricultural exports such as almonds and cranberries. These tariffs were not only a response to Trump’s measures but also a statement of the EU’s commitment to maintaining the integrity of multilateral trade systems.

The EU has also pursued legal action against the U.S. within the World Trade Organization (WTO), arguing that Trump’s tariffs violate international trade rules. In the meantime, European businesses have faced challenges, including higher import costs and disrupted supply chains. The EU has sought to mitigate the economic damage by diversifying its trade relationships and pushing for new trade agreements with countries outside the U.S. sphere of influence.

India: Navigating Tariff Escalation with Strategic Trade Policy

India, as an emerging economic powerhouse, has also felt the brunt of Trump’s tariffs. The U.S. imposed tariffs on Indian steel and aluminum, while also targeting Indian agricultural products like almonds, apples, and cotton. These tariffs were designed to protect U.S. manufacturing and agriculture, which are seen as vital to the American economy.

In response, India has retaliated with its own tariffs on U.S. goods, including motorcycles, fruits, and nuts. India’s government has also taken steps to shield its domestic industries from the impact of U.S. tariffs, particularly in the steel and agriculture sectors. The country has focused on strengthening its relationships with other trading partners, including Japan, China, and the European Union.

India has also sought to protect its growing technology sector, which has been hit by U.S. tariffs on software and IT services. The Indian government has been vocal in its opposition to the U.S. tariffs, calling for a multilateral approach to resolving trade disputes.

Mexico and Canada: Close Neighbors with Diverging Responses

Mexico and Canada, two of the United States’ closest trading partners, have also been deeply affected by Trump’s 2025 tariffs. In response to U.S. tariffs on steel and aluminum, Mexico imposed retaliatory tariffs on U.S. agricultural products such as pork, apples, and cheese. Similarly, Canada implemented tariffs on U.S. goods like ketchup, whisky, and toilet paper.

Despite these retaliations, both Mexico and Canada have worked to maintain their trade relationships with the U.S. through the United States-Mexico-Canada Agreement (USMCA). However, the ongoing tariff disputes have strained these relationships, with both countries seeking to diversify their export markets and reduce their dependence on the U.S.

Japan: Facing Tariff Challenges with Limited Retaliation

Japan, another significant trading partner of the U.S., has faced a mix of challenges due to Trump’s tariffs. The U.S. imposed tariffs on Japanese steel and aluminum, while also targeting Japanese automobiles and automotive parts. In response, Japan has implemented limited retaliatory tariffs, focusing primarily on U.S. agricultural products like wheat, corn, and beef.

Japan has sought to address the impact of U.S. tariffs by diversifying its trade relationships, particularly with countries in the Asia-Pacific region. The Japanese government has emphasized the importance of multilateral trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), to counterbalance the negative effects of U.S. tariffs.

Brazil, South Korea, and Other Countries: Diverse Reactions Across the Globe

Countries like Brazil, South Korea, and several others have had varied responses to Trump’s 2025 tariffs. Brazil, a major exporter of soybeans, has been heavily impacted by U.S. tariffs on agricultural goods. In response, Brazil has imposed tariffs on U.S. industrial products and sought to expand trade with China and other global powers.

South Korea has faced tariffs on steel and automobiles, leading to retaliatory measures on U.S. goods such as cosmetics, electronics, and agricultural products. South Korea has also looked to strengthen trade partnerships with regional allies, including Japan and China, as part of its strategy to reduce reliance on the U.S. market.

Other countries, including Vietnam, Turkey, and Indonesia, have similarly sought to protect their economic interests by implementing tariffs on U.S. goods. These countries have also sought to diversify their trade relationships, emphasizing the importance of global trade cooperation and regional economic partnerships.

Breakdown of Tariffs by Country

Note: In this section, each country’s specific tariffs will be outlined along with the tariffs the U.S. has imposed on them.

- China:

- U.S. Tariffs on China: 25% on $250 billion worth of imports (steel, electronics, agriculture, machinery).

- China’s Retaliation: 25% tariffs on U.S. soybeans, pork, corn, cars, and aircraft.

- European Union:

- U.S. Tariffs on the EU: 25% on steel, 10% on aluminum, and tariffs on automobiles.

- EU’s Retaliation: 25% on American whiskey, motorcycles, and agricultural products (almonds, cranberries).

- India:

- U.S. Tariffs on India: 25% on steel, aluminum, and agricultural products.

- India’s Retaliation: 25% tariffs on U.S. motorcycles, fruits, and nuts.

- Mexico:

- U.S. Tariffs on Mexico: 25% on steel and aluminum.

- Mexico’s Retaliation: Tariffs on U.S. pork, apples, and cheese.

- Canada:

- U.S. Tariffs on Canada: 25% on steel and aluminum.

- Canada’s Retaliation: Tariffs on U.S. ketchup, whisky, and toilet paper.

- Japan:

- U.S. Tariffs on Japan: 25% on steel, tariffs on automobiles.

- Japan’s Retaliation: Limited tariffs on U.S. agricultural products like wheat and beef.

- Brazil:

- U.S. Tariffs on Brazil: Tariffs on soybeans and steel.

- Brazil’s Retaliation: Tariffs on U.S. industrial products.

- South Korea:

- U.S. Tariffs on South Korea: 25% on steel, automotive tariffs.

- South Korea’s Retaliation: Tariffs on U.S. cosmetics and agricultural products.

- Other Countries:

- Vietnam, Turkey, Indonesia: Diverse tariff responses targeting U.S. agricultural goods and industrial products.

Conclusion: The Ongoing Global Trade Repercussions

The global tariff landscape in 2025 continues to evolve as countries like China, the European Union, India, and others respond to U.S. trade policies. The retaliatory tariffs imposed by these nations have reshaped international trade dynamics, affecting a wide range of industries such as agriculture, technology, automotive, steel, and consumer goods. As each country reacts with specific retaliatory measures, both sides face economic challenges, leading to a more complex global trade environment.

This ongoing trade war presents new opportunities and risks for businesses globally, with each nation trying to protect its economic interests while navigating the shifting trade policies. The long-term effects of these tariffs will depend on the ability of nations to negotiate, adjust, and adapt to new trade realities in the coming years.